Join day by day information updates from CleanTechnica on e mail. Or observe us on Google Information!

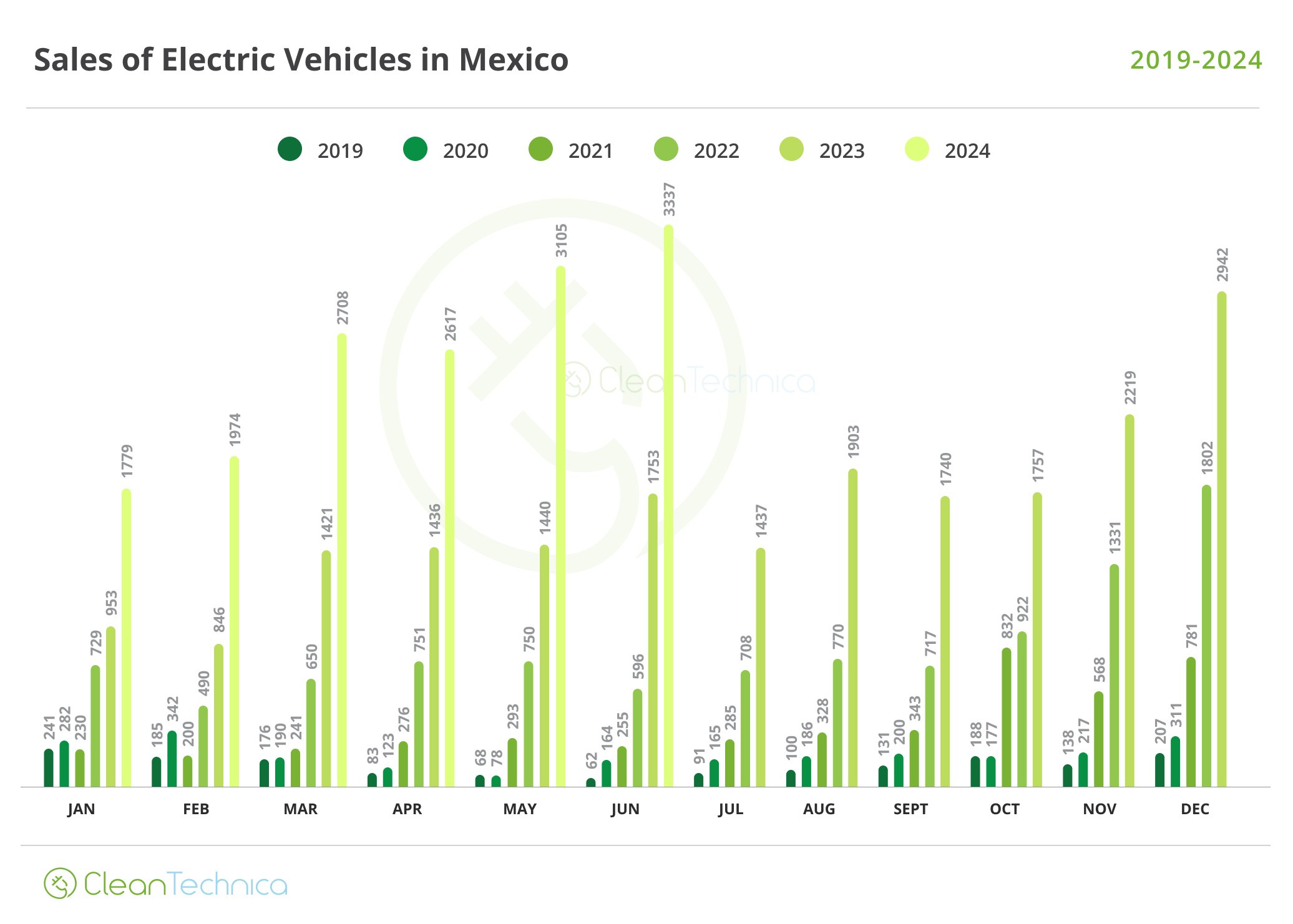

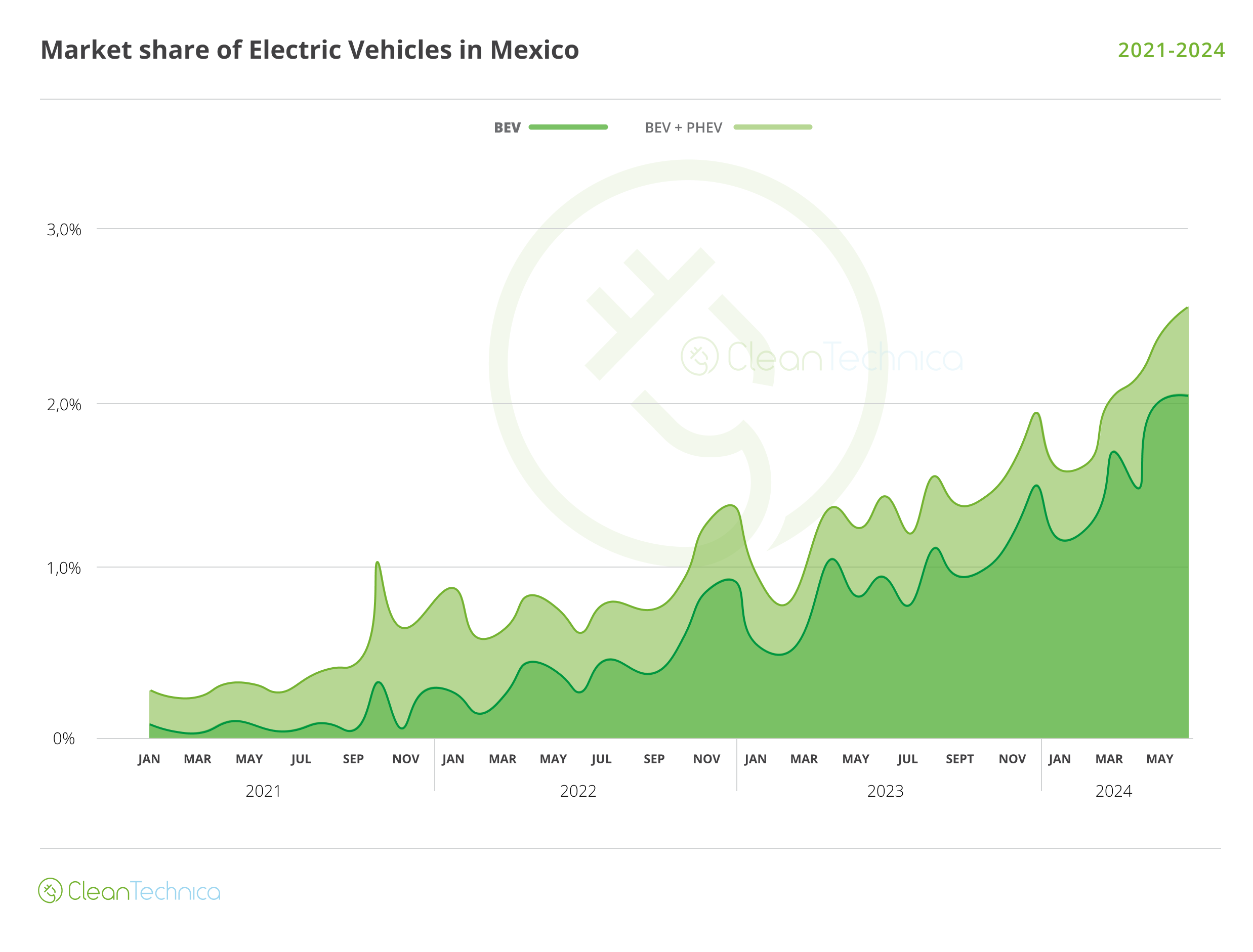

Dwelling to the biggest and best auto trade in Latin America, Mexico was a latecomer to the electrification race, presenting marginal EV gross sales till late 2021 (with sub-0.1% BEV market share). Again then, this was a PHEV-focused market, with plug-in hybrids a minimum of capable of make some presence, and BEVs all however absent from the market. See the next chart for 2021–2022:

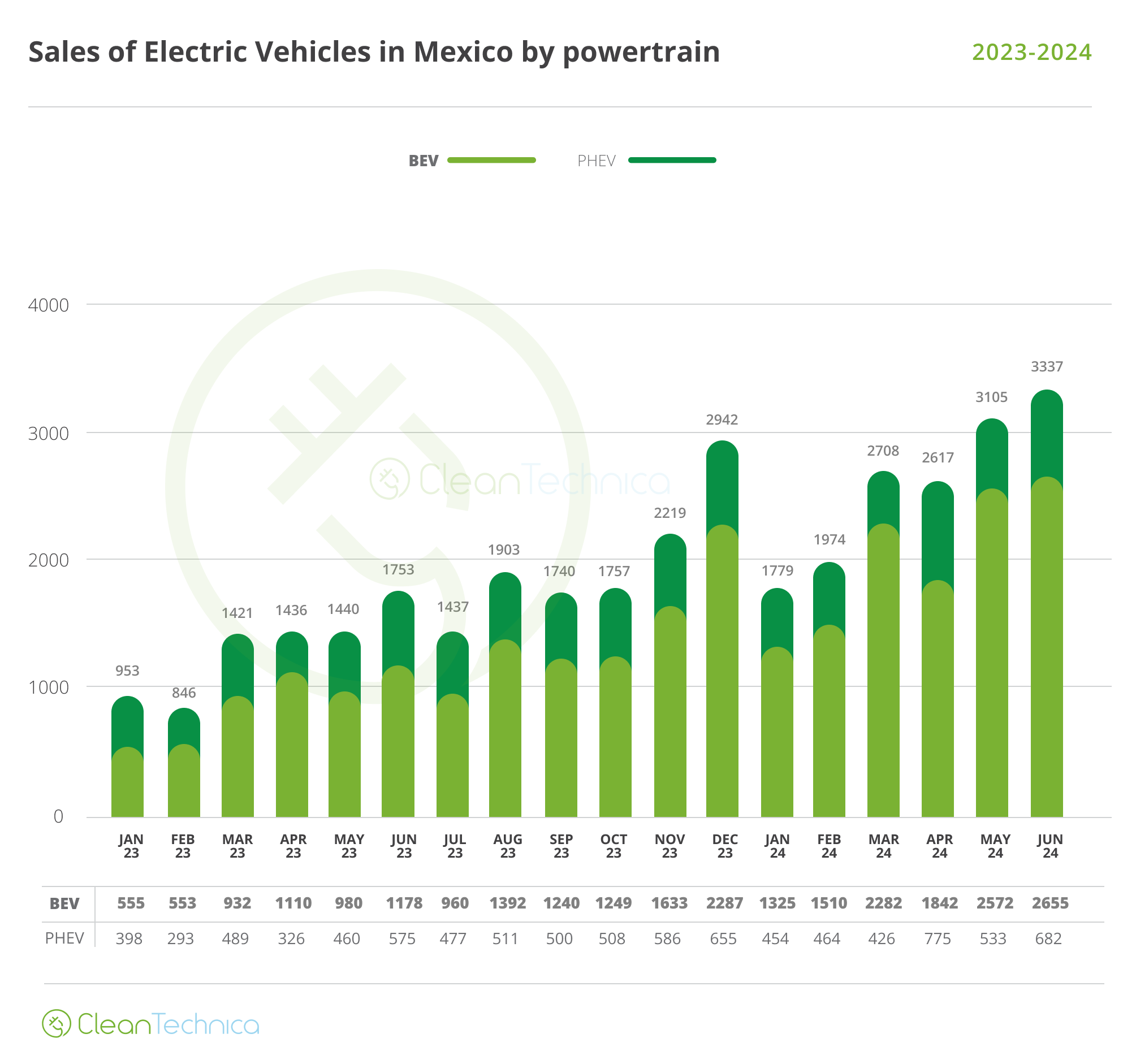

The final three years have introduced constant development YoY for EVs (~100% annually). Although, it’s BEV gross sales which have exploded (400% development in 2022, 300% in 2023) whereas PHEV gross sales have grown by a lot much less (~25% development in 2022 and 2023). EV development stays excessive in 2024, and with Mexico changing into an area the place Chinese language EV makers will battle established US producers, it undoubtedly stays one of the crucial attention-grabbing markets to observe.

Common Market Overview

To date, 2024 has introduced constant development in EV gross sales, not solely YoY, but additionally month on month — March, Could and June all introduced new information within the nation.

Market-share sensible, Mexico lags the regional leaders (Costa Rica and Uruguay) and the “second tier” markets (Colombia and Brazil), however it’s nonetheless an necessary participant, having simply surpassed 2.5% share (2% for BEVs alone) in June, up from 1.2% a 12 months in the past.

It’s clear from this graph that PHEV gross sales are nearly fixed, and although they did enhance YoY, this was as a result of they fell in H1 2023:

We Don’t Know The Market Leaders … However We Can Guess

There was a difficulty when engaged on this report: we don’t know who’s main the Mexican market.

The knowledge introduced by Mexico’s official establishments solely tracks mannequin gross sales by producers who’ve joined the Mexican Automotive Trade Affiliation … and the probably leaders of the market (Tesla, BYD, and maybe SEV) don’t belong to it. Which means that although we’ve got entry to combination knowledge on EV gross sales, we solely have particular knowledge for fashions from the opposite producers.

Checking that very lengthy record and searching for all of the EVs that disguise in there, we discovered that the Volvo EX30 has been an unsurprising success, registering 1,561 items throughout the first six months of 2023. JAC additionally has a few first rate promoting fashions (the E-Sunray van, with 1,001 gross sales, and the reasonably priced E10X, with 874 gross sales), adopted by the ORA 03 (517 gross sales) and the Renault Kwid E-Tech (250 gross sales). The presence of China on this record is plain even with out BYD!

There’s extra data we will guess with the out there knowledge. Whole BEV gross sales throughout 2024 have amounted to only over 12,000 items, but I solely managed to trace half of them within the record relating to fashions: because of this BYD, Tesla, and SEV personal half of the Mexican EV Market. And although SEV has been making an effort to develop into a acknowledged model in Mexico, I doubt it’s an enormous participant but. This principally implies that BYD and Tesla, collectively, are prone to have a minimum of 5,000 registrations to date this 12 months, and maybe slightly extra. I’d wager that above all, the EVs beforehand listed lie under the BYD Seagull, Tesla Mannequin 3, Tesla Mannequin Y, and BYD Music (in all probability in that order).

Eventually, it’s attention-grabbing to notice the absence of Hyundai/Kia on this record. The Hyundai Kona is absent altogether, the Kia Niro is simply bought as an HEV, and the EV6 and Ioniq 5 have fewer than 60 gross sales every. Kia is planning EV manufacturing in Mexico within the close to future: might or not it’s that it’s ready for native manufacturing to not cannibalize its present factories within the nation?

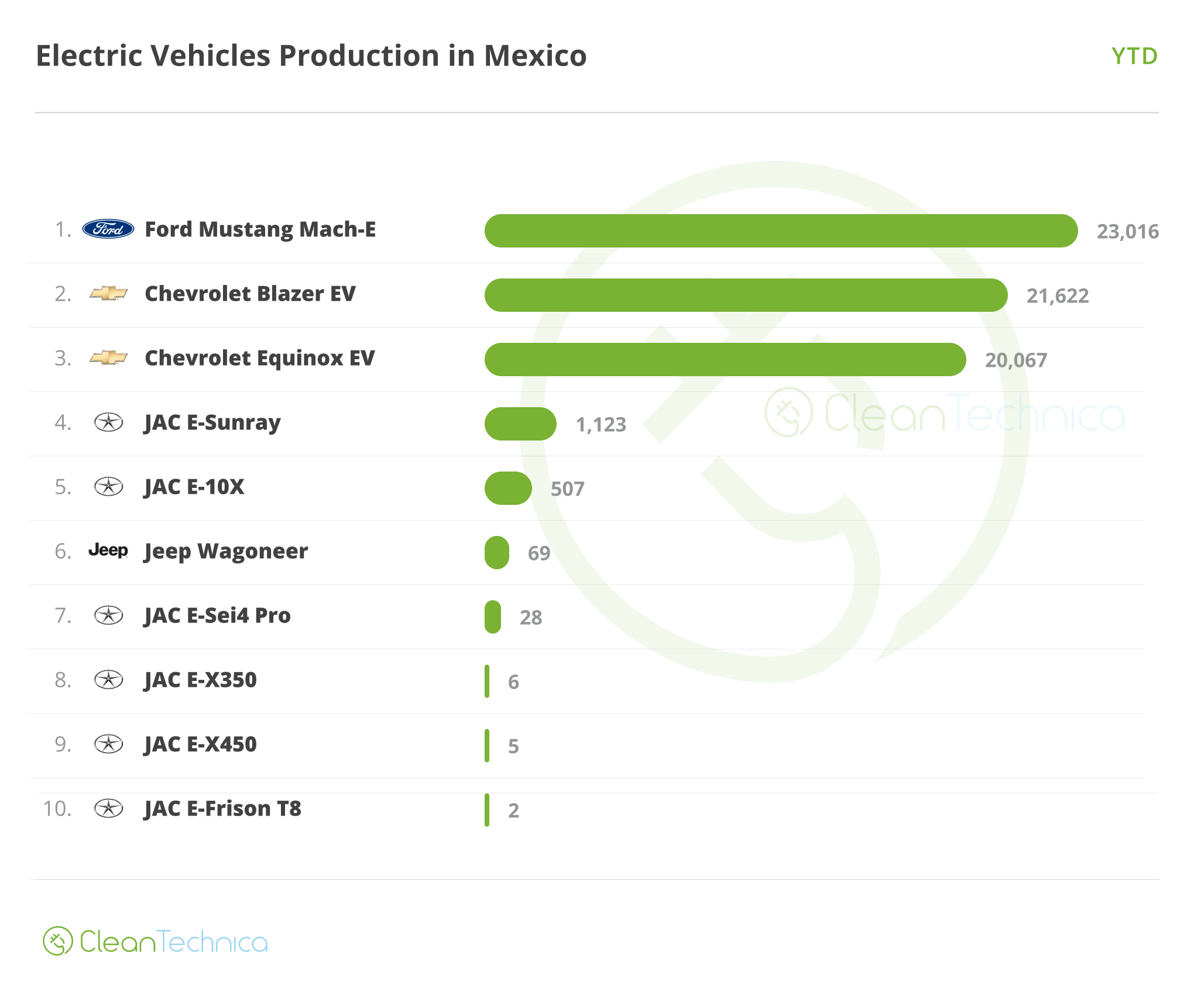

Mexico Ramping Up EV Manufacturing

Mexico is maybe the one nation on the planet the place gross sales knowledge by mannequin should not available, however automobile manufacturing knowledge is. Which means that although we can’t current the market leaders so far as registrations go, we do have some attention-grabbing knowledge relating to EV manufacturing to date this 12 months:

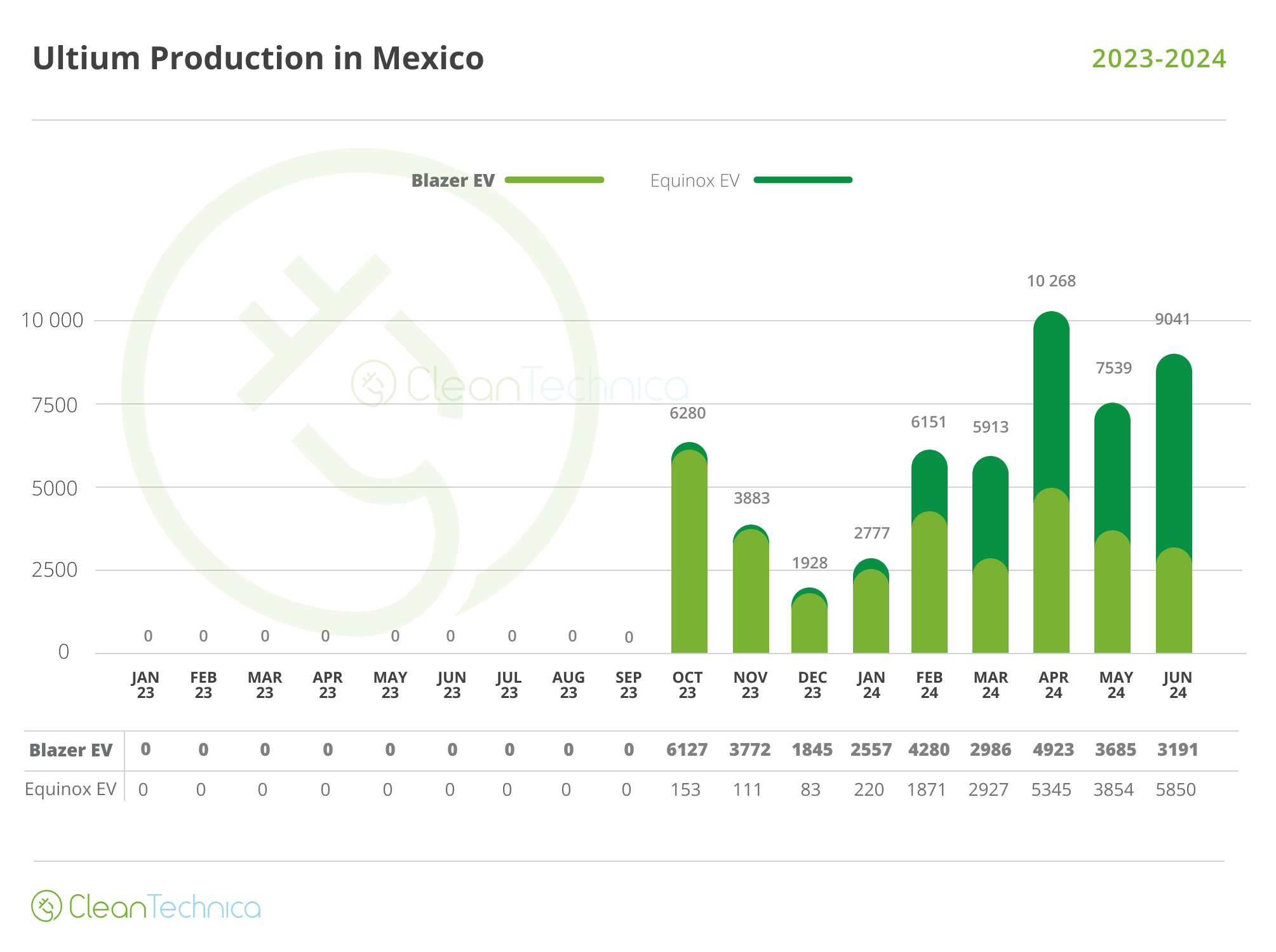

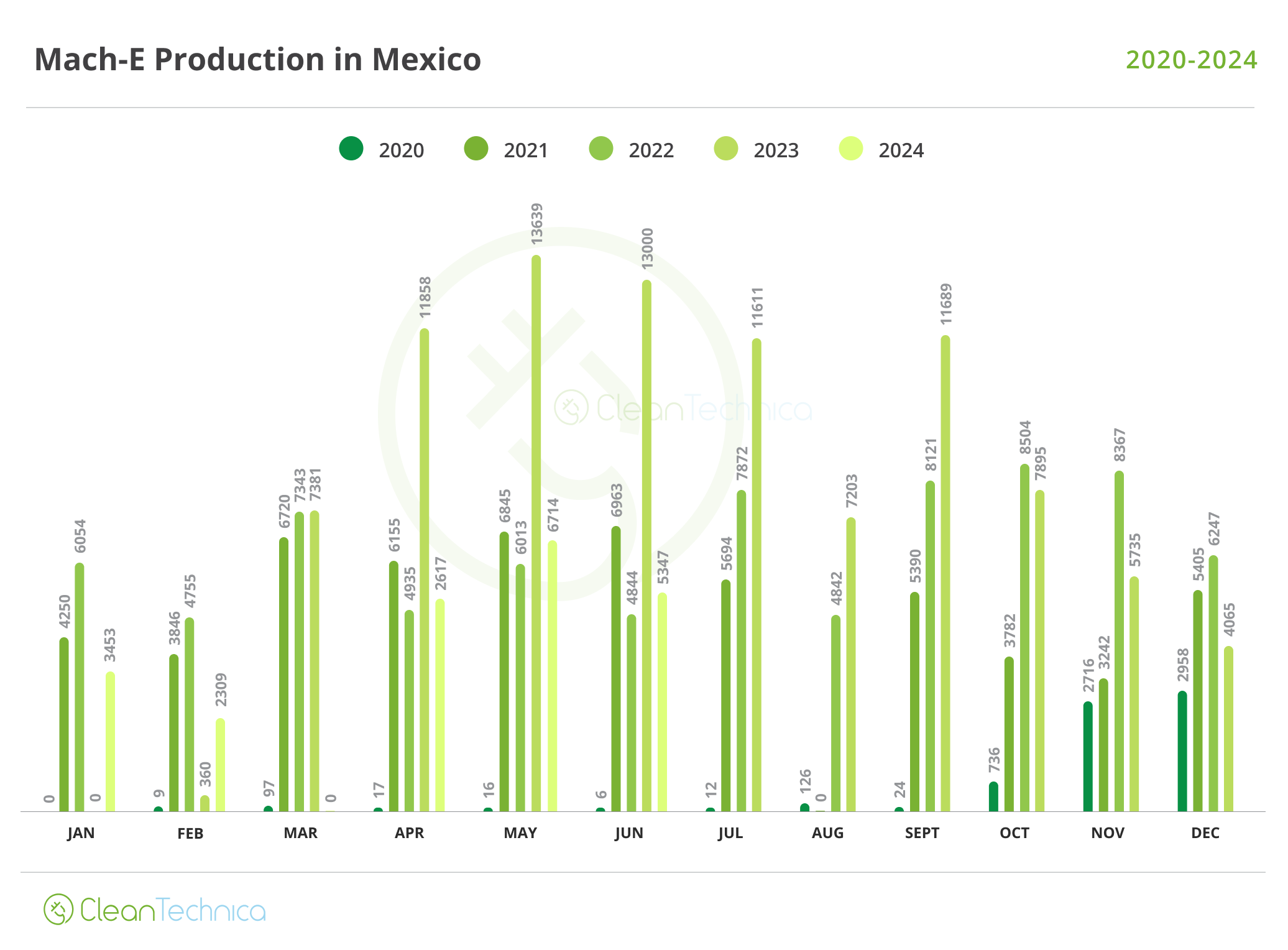

A lot has been stated about Chinese language manufacturers coming to supply on Mexican soil, however it’s clear for now Mexico stays the turf of US manufacturers, particularly Ford and GM. The getting older Ford Mustang Mach-E is the chief so far as manufacturing goes, however almost 100% of those went to the US or elsewhere (solely 72 have been bought in Mexico); the Ultium siblings observe carefully behind (with no registrations in Mexico) … and in a distant fourth place, there’s the JAC E-Sunray van.

Mexican manufacturing is set firstly by US demand, so not a lot may be learn into this knowledge relating to Mexico particularly. Nonetheless, as one of many important manufacturing hubs in all the Americas, Mexican manufacturing can be utilized as a proxy to seek out out what’s happening in different markets, primarily — however not completely — the US.

An attention-grabbing distinction seems between the ramp-up of the Ultium siblings (Blazer and Equinox EV) and the declining manufacturing of the Mustang Mach-E. The previous are alleged to develop into the cornerstone of the Ultium ramp-up for Common Motors and can begin gross sales in Mexico within the following months. Manufacturing peaked in April, however June wasn’t far behind, and, if gross sales sustain, we should always see even bigger numbers within the months to return. I’ve stated it earlier than, however it bears repeating: I’ve excessive hopes for the Equinox EV within the Latin American market.

(Oh, and don’t let October’s knowledge idiot you. The Blazer had been in manufacturing since early 2023 — Chevrolet merely registered a complete semester’s manufacturing in that one month, and therefore the excessive quantity.)

In the meantime, the Mach-E has been affected by some severe blues, and manufacturing these days falls far under its peak a 12 months in the past. It frankly surprises me that after a 4-year ramp-up, Ford appears to be unable to each make a revenue on this automobile and promote it at a value that brings sufficient demand to maintain mass manufacturing. If (and this can be a huge if) GM manages to get a revenue on the Ultium siblings by late 2024, as Ibarra say they’d, it means the corporate may have managed to do in two years what Ford couldn’t do in 4.

Following our record, so far as JAC goes, its manufacturing provides most of Latin America’s demand for this model, that means each the E-Sunray and the E10X are essentially the most demanded fashions south of the Rio Bravo (whereas the E-Sei 4 and others appears to be on their method out). This suits the knowledge out there in different markets … and admittedly surprises me: the E-Sei 4 (E40X in some markets) is one hell of a handsome CUV.

Eventually, it appears Jeep is beginning manufacturing of the Wagoneer. I’m not a fan of very massive SUVs, however each EV out there may be one much less ICE automobile, so I want this large Jeep one of the best of luck. Could you eat the market share of your gasoline-thirsty brothers!

Last Ideas

Mexico departed from a low base, however it’s been rising for a very long time now, sufficient to say this can be a constant development. Extra importantly, in addition to YoY development, there was development month on month, which suggests the arrival of reasonably priced EVs is making a distinction and we’re seeing a relentless enhance in curiosity.

Nonetheless, 2.5% remains to be too low, and notably so for a market as massive as Mexico. Inertia is a strong pressure, and whereas some smaller markets might change a lot sooner, I’ve my doubts Mexico will likely be in a position to take action earlier than vital EV manufacturing ramps up within the nation. The excellent news is: that second shouldn’t be too far-off.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage