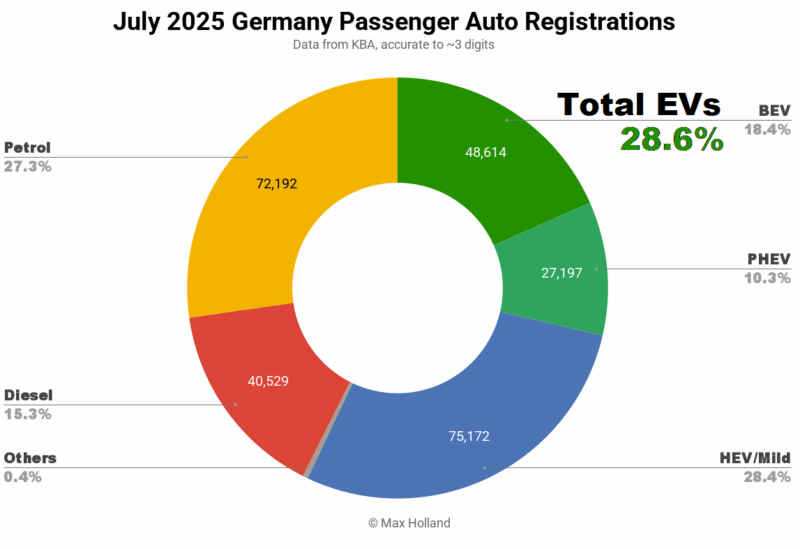

July noticed plugin EVs at 28.6% share in Germany, up from 19.1% share year-on-year. BEV quantity elevated by 58% YoY, whereas PHEVs grew 84%. General auto quantity was 264,802 items, up some 11% YoY. July’s best-selling BEV was the Volkswagen ID.3.

July’s auto gross sales noticed mixed EVs at 28.6% share in Germany, with full electrics (BEVs) at 18.4% share, and plugin hybrids (PHEVs) at 10.3%. These evaluate with YoY figures of 19.1% mixed, 12.9% BEV, and 6.2% PHEV.

The YoY baseline (July 2024) was weak, with the EV market then nonetheless reeling from the late December 2023 shock cancellation of BEV incentives. Thus the YoY progress figures might seem significantly spectacular. Stepping again, Germany is now barely forward of France on EV market share (principally because of stronger PHEV share), and considerably behind the UK market. That is nonetheless a welcome return to a progress trajectory from final yr’s back-sliding.

The year-to-date cumulative mixed EV share is now 27.8% with 17.8% BEV, and 10.0% PHEV. The equal figures from 2023 YTD have been 22.1% mixed, with 16.4% BEV, and 5.7% PHEV.

We will see that PHEVs have grown share strongly, which is comprehensible on condition that the most recent technology usually have over 80km of all-electric vary, and might cowl most of their annual driving on electrical energy. At this stage of the transition in Germany, PHEVs nonetheless have a task to play, although they’re now passé in a extra superior market like Norway, and have gotten so in China additionally (not counting EREVs, that are nearer to BEVs than to hybrids).

Mixed EVs are forward of petrol-only gross sales once more, and have been for five of the 7 months to date in 2025. They are going to doubtless keep forward sooner or later.

If we mix petrol-only and diesel-only, these ICEs are nonetheless forward of mixed EVs, with 42.6% share in July, although that could be a large fall from the 52.1% of July 2024. Anticipate these ICE-only gross sales to fall under 40% by This autumn this yr, and certain keep below 40% subsequent yr.

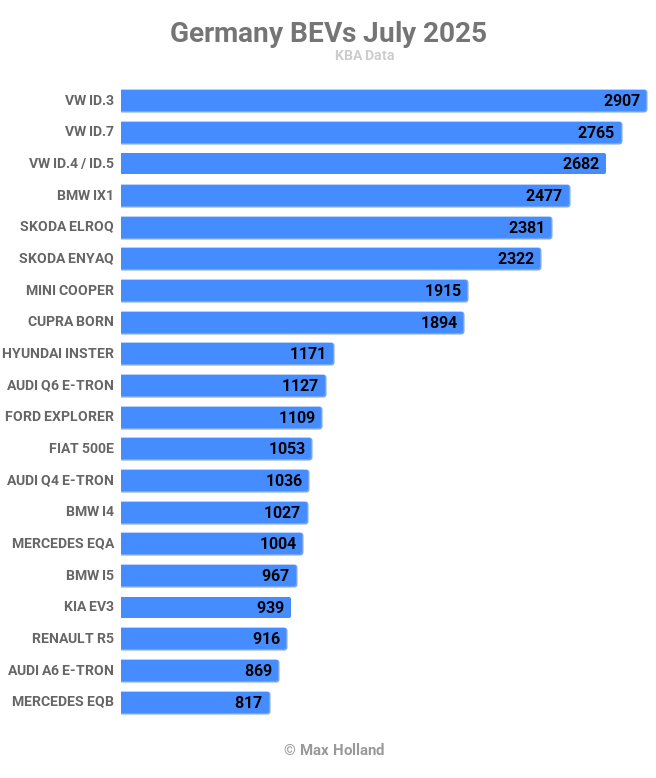

Greatest-Promoting BEV Fashions

The Volkswagen ID.3 once more took the highest spot in July, with 2,907 items, sustaining its lead from June. In second place was the ID.7, with 2,765 items, simply forward of one other Volkswagen mannequin, the ID.4/ID.5 in third, with 2,682 items. This can be a satisfying high 3 end result for the Volkswagen model in its house market.

Additional again, actions have been pretty minor, with the BMW iX1 climbing 2 spots to 4th, and the Skoda Elroq dropping 3 spots to fifth. Simply exterior the highest 5, the Mini Cooper improved just a few spots to seventh, and the Audi This autumn e-tron improved a number of spots to thirteenth. Again in seventeenth spot, the Kia EV3 noticed its largest ever quantity, with 939 items, although be aware that it does are inclined to arrive in irregular batches from Korea.

The very best climber of any new mannequin launched this yr was the Ford Puma, far again in forty fourth place (243 items), adopted by the Renault 4 in forty seventh place (226 items).

The MG S5, which debuted in June with 78 items, held its floor in July, with 71 items. The opposite important June debutant, the Hyundai Ioniq 9, elevated from 6 to 39 items.

The small-and-affordable fashions have been led by the Hyundai Inster with a robust 1,171 items (rating ninth). Not too far behind was the Renault 5, with 916 items (ranked 18th).

The Citroen e-C3 was a way again with a private better of 547 items, solely simply forward of the Dacia Spring with 518 items, each far exterior the highest 20. The Leapmotor T03 additionally noticed a private better of 438 items. The BYD Dolphin Surf had an enormous month in June (817 items), however was on a logistics ebb in July with simply 36 items.

Let’s now flip to the trailing 3-month outcomes:

Volkswagen Group fashions stay very sturdy, and took the highest 5 spots within the July desk (and a pair of additional spots within the high 10). The brand new Skoda Elroq has now consolidated its place in Germany, with its second consecutive month within the high three spots.

Essentially the most important mover was the Hyundai Inster, up 9 locations from the prior interval, to tenth spot. This can be a nice end result, and the Inster is now HMG’s finest promoting BEV in Germany by a good margin (the EV3 is in nineteenth spot).

By way of the upward progress of different new fashions, the BYD Dolphin Surf is now in forty first spot, after only one quantity month (June). The Ford Puma is in forty third after 4 regular however flat months of quantity, and will have discovered its consolation zone (till Ford wants to fulfill tighter emissions guidelines, and promote extra). After simply two rising months, the brand new Renault 4 is in 53rd spot and is ready to maintain climbing. Let’s keep watch over the Surf and the 4 within the coming few months as they climb greater.

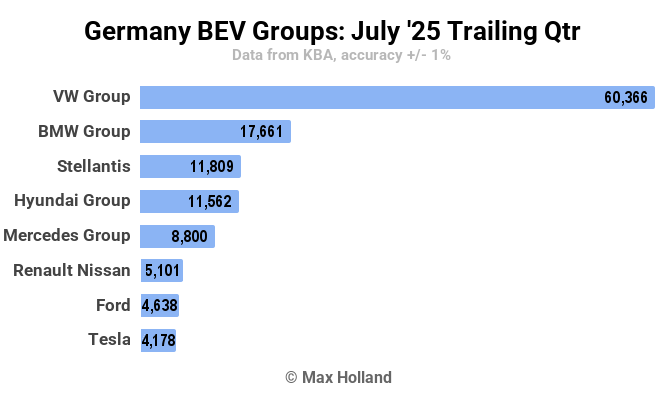

Manufacturing Group Rankings

As Germany is Europe’s largest single auto market, and one for which pretty full market information is promptly obtainable, it’s price doing a producing group spherical up, with the caveat that different giant European markets have a really completely different steadiness of manufacturers and teams (e.g. France).

Over the most recent three months, the highest 10 ranks have barely modified because the prior interval (February to April). Far forward in high spot, Volkswagen Group grew its gross sales 4% over the prior three months, to over 60,000 items, and took 43.9% of the German BEV market. This was a slight dip from 47.4% over the prior interval, doubtless as a result of the Group has additionally pushed quantity into different international locations round Europe.

BMW Group stays in second place, having grown gross sales by 24%, and gained a further 1.2% slice of the market, now at 12.8%. Stellantis has now superior to 3rd, grew 26% gross sales quantity and grabbed a further 0.9% share to assert 8.6%. It swapped locations with HMG, which grew quantity by a smaller 17% and gained 0.3% (to occupy 8.4%).

In fifth and sixth spots Mercedes Group, and Renault-Nissan, are pretty static, with little change over the prior interval.

Ford grew its gross sales by 42% over the prior interval and gained a further 0.7% market share to occupy 3.4% share. This progress in share superior Ford by two ranks to seventh spot, displacing Tesla down a spot, and pushing Geely simply exterior the highest 8.

Tesla was the one one of many high 10 teams to lose quantity (by 8%) over the prior interval, and misplaced 0.7% market share, now down to three.0% share.

With Geely (3.0%) in ninth, BYD is now in tenth spot (with 2.3% share). Be aware that BYD – with its big selection of fashions, together with inexpensive fashions – has already overtaken Tesla to develop into the best-selling BEV model in each Spain and Italy in H1 2025. It’s straightforward to envisage BYD probably overtaking Tesla in Germany within the coming 6 months or so.

Outlook

Germany’s EV transition is now on a welcome restoration observe since its disastrous 2024. PHEVs are doing a little heavy lifting, however that’s okay at Germany’s stage of the transition, and BEVs are nonetheless rising at a wholesome clip, up in quantity by 38.4% year-to-date. That is regardless of the general market being down YTD by round 1%.

The German economic system remains to be very weak, however the newest “revisions” by the federal statistics workplace have turned Q1’s 0% YoY GDP progress to +0.3%, the primary constructive financial information in over two years. Q2 appears to have continued the pattern to 0.4% YoY GDP progress.

Headline inflation stays at 2%, ECB rates of interest stay at 2.15%, and manufacturing PMI was virtually flat at 49.1 factors in July, from 49.0 in June. Each shopper confidence and enterprise confidence stay weak, nevertheless.

Will Germany stay on an EV progress trajectory for the remainder of the yr? Which fashions will proceed to climb within the months forward, and what new fashions may have a major early influence? What additional segments and worth factors at the moment are most wanted to speed up the transition? Please share your ideas and views within the feedback part.

Join CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and excessive degree summaries, join our day by day publication, and observe us on Google Information!

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Join our day by day publication for 15 new cleantech tales a day. Or join our weekly one on high tales of the week if day by day is just too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage