Join each day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

The August auto market noticed plugin EVs at 22.4% share in France, down from 25.7% 12 months on 12 months. Quantity of each BEVs and PHEVs was every down by over 33% YoY, declining greater than the general market drop. General auto quantity was simply 85,977 models, down 24.3% YoY, the weakest August since 2014, and much under 2016–2019 seasonal norms (~121,300). The Tesla Mannequin Y was France’s finest promoting BEV in August.

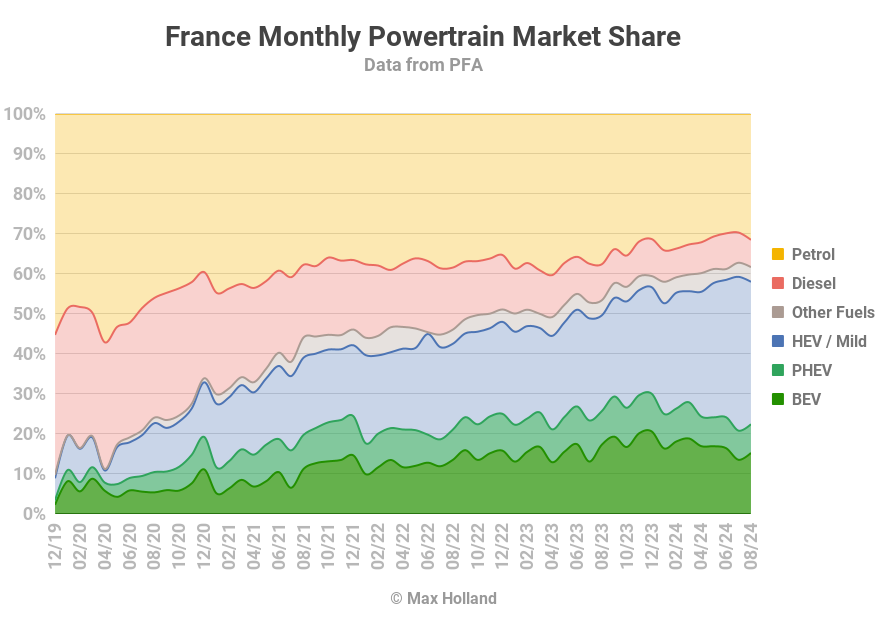

August noticed mixed EVs at 22.4% share in France, with full battery electrics (BEVs) at 15.2%, and plugin hybrids (PHEVs) at 7.2%. These evaluate with respective YoY figures of 25.7% mixed, 17.3% BEV, and eight.4% PHEV.

We’ve steadily raked over the dimming coals of France’s EV progress in our market reviews from the previous few months. Briefly, the mid-March incentive lower for non-European BEVs, the present hangover following the non permanent social-leasing programme initially of the 12 months, and July’s begin of profit-protectionist anti-China tariffs by the EU, are all having a severely damaging impact on progress.

This exhibits by means of available in the market knowledge. Though January to April (cumulative) noticed BEV quantity up by some 27.7% YoY, the Might to August determine is down by 9.3% YoY. Because of the early increase, the YTD quantity complete continues to be nearly within the constructive YoY by 8.1%, or some 14,000 models. PHEV quantity is, nonetheless, down by round 11% YoY.

Luckily the slack is no less than being taken up by conventional (plugless) hybrids (HEVs), fairly than combustion-only automobiles. Yr to this point, HEV volumes (together with gentle hybrids) are up by some 36% YoY, to a cumulative complete of 359,532 models, and 31.9% market share.

Conventional combustion-only powertrain gross sales stand at 446,992 models YTD, down from 545,705 at this level final 12 months. Cumulative market share is 39.6%, down decently from 48.2% YoY.

Diesel-only volumes proceed to shrink, with 87,728 YTD cumulative gross sales, down from 116,607 YoY. Diesel market share (pink section under) to date in 2024 has fallen to 7.8%, from 10.3% YoY.

That discount development, if it holds, tracks in the direction of diesels being beneath 2.5% share in 4 years time, and round 1% share in 7 years time. Within the ultimate world this may occur a lot sooner — if inexpensive BEVs are allowed to be bought in Europe. Don’t rely on it although; the European ruling lessons could choose to take care of file income for legacy automakers, and wage bonuses for the auto-managerial 1%, coming from squeezing ever extra gross sales juice out of previous ICE investments.

Greatest Promoting BEV Fashions

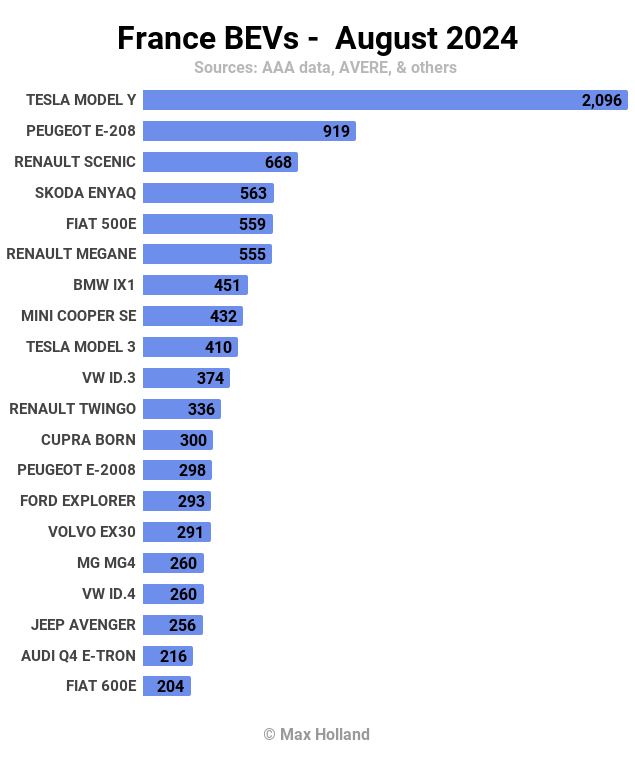

August noticed the Tesla Mannequin Y bounce strongly again into the gross sales lead, after a protracted absence, with 2,096 models bought.

The same old favorite, the Peugeot e-208, was relegated to second place with 919 models. The Renault Scenic got here in third, its finest ever place, with 668 models.

Provided that solely ~87,000 complete autos had been bought in August, the Tesla Mannequin Y’s 2,096 models (over 2.4% of the auto market) virtually actually put it inside the highest 3 total finest promoting autos, an important outcome. Usually, this type of Tesla efficiency is barely seen within the last month of 1 / 4 — let’s see what September brings.

The Renault Scenic did effectively to climb to its file third place, from 4th final month, and tenth in June. It appears to have now displaced its older sibling, the Megane, which is now again in sixth. Let’s see if it is a everlasting association.

Given the sluggish month total, just about each different BEV mannequin noticed gross sales decrease than latest averages. The Skoda Enyaq outperformed in relative phrases, sustaining latest common volumes and thus coming in 4th, up from 18th in July.

The brand new Ford Explorer BEV is now on sale in France, having debuted in neighbouring Germany in July. It scored a wholesome 293 French gross sales in August. Let’s see if these models are fulfilling a protracted standing backlog of orders from Ford sellers and loyalists, or whether or not this quantity will be sustained, and even maybe develop additional.

Recall that the Ford Explorer is the model’s tackle the Volkswagen ID.4, sharing the identical MEB-platform underpinnings. For extra particulars, see the July Germany report.

There have been reportedly 20-something Renault 5 BEV vendor deliveries in August, these are doubtless early pre-production models, meant for sellers to be taught the mannequin, and maybe enable some test-drives. We are able to’t anticipate massive buyer deliveries till the tip of the 12 months, or early 2025.

Let’s test the 3-month outcomes:

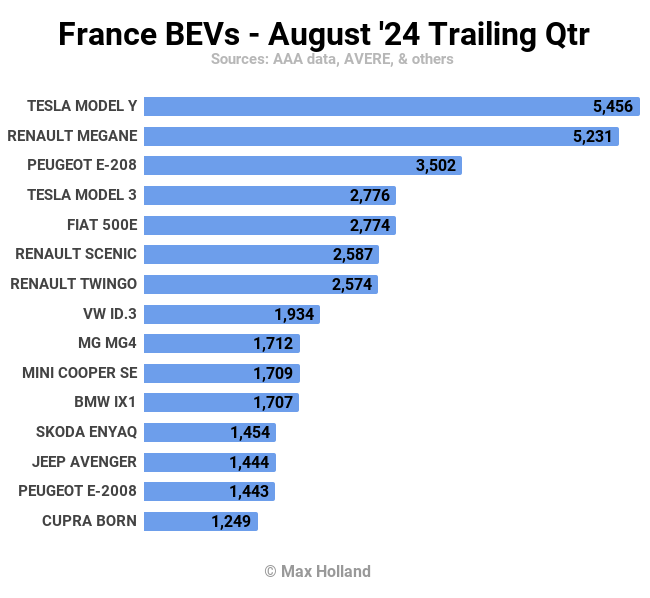

July’s chart had seen the Renault Megane take the highest spot for the primary time, however the Megane has now fallen to the Tesla Mannequin Y, albeit by an in depth margin. We are able to anticipate the Megane to remain within the high 3 for some time longer, nonetheless, in the long term it seems set to be much less well-liked than its extra sensible sibling, the newer Renault Scenic.

The Citroen e-C3 continues to be delayed, with no additional information since final month’s announcement of “software program points”. Once more, because the 2024 EU rules don’t require emissions enhancements over 2023, we are able to’t anticipate legacy producers (who wish to squeeze out extra ICE income) to hurry to get inexpensive BEVs to market — till they’re pressured to.

In Europe, the subsequent sensible emissions tightening solely arrives in 2025, so the likes of Renault and Citroen will delay vital supply volumes of their extra inexpensive BEVs till then.

Outlook

As mentioned above, BEVs are actually lowering in YoY quantity, as is the general auto market. The French financial system as a complete noticed GDP development sluggish to only 1% in Q2, from 1.5% in Q1. That is however nonetheless barely higher than the Euro space common, which is at present creeping alongside at 0.6% development (Q2 2024).

France’s inflation charge diminished to 1.9% in July (newest), and rates of interest stay at 4.25%. Manufacturing PMI stayed weak in August at 43.9 factors, from 44 factors in July.

Once more, because the EU rules will not be setting more durable emissions targets for 2024, (and legacy auto needs to proceed to revenue from their previous), we are able to’t anticipate BEV (or broader plugin) development for the remainder of the 12 months. 2025 will begin to see modest enhancements, nonetheless.

What are your ideas on France’s EV journey? Please be part of within the dialogue under.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage