Final Up to date on: 2nd July 2025, 03:03 am

Europe’s leasing corporations have made little to no significant local weather commitments, regardless of their rising affect and key position in decarbonising the automotive sector.

Throughout Europe, leasing has develop into the principle approach of accessing new automobiles. The sector already accounts for over 50% of latest registrations, a determine anticipated to rise to 70% by 2030.

This shift offers leasing corporations — subsidiaries of carmakers (e.g. Mobilize for Renault) or banking teams (e.g. Ayvens for Société Générale, Arval for BNP Paribas) — vital energy in shaping the EV transition. These corporations are key intermediaries between carmakers and shoppers. They set listed month-to-month costs for brand spanking new fashions, which affect how engaging electrical autos are to shoppers. Additionally they information clients via the transition — or fail to take action. And so they handle the resale of autos on the finish of the lease interval, shaping the second-hand market, the place eight out of 10 Europeans purchase their automobiles.

Worrying lack of transparency, weak and inconsistent local weather targets

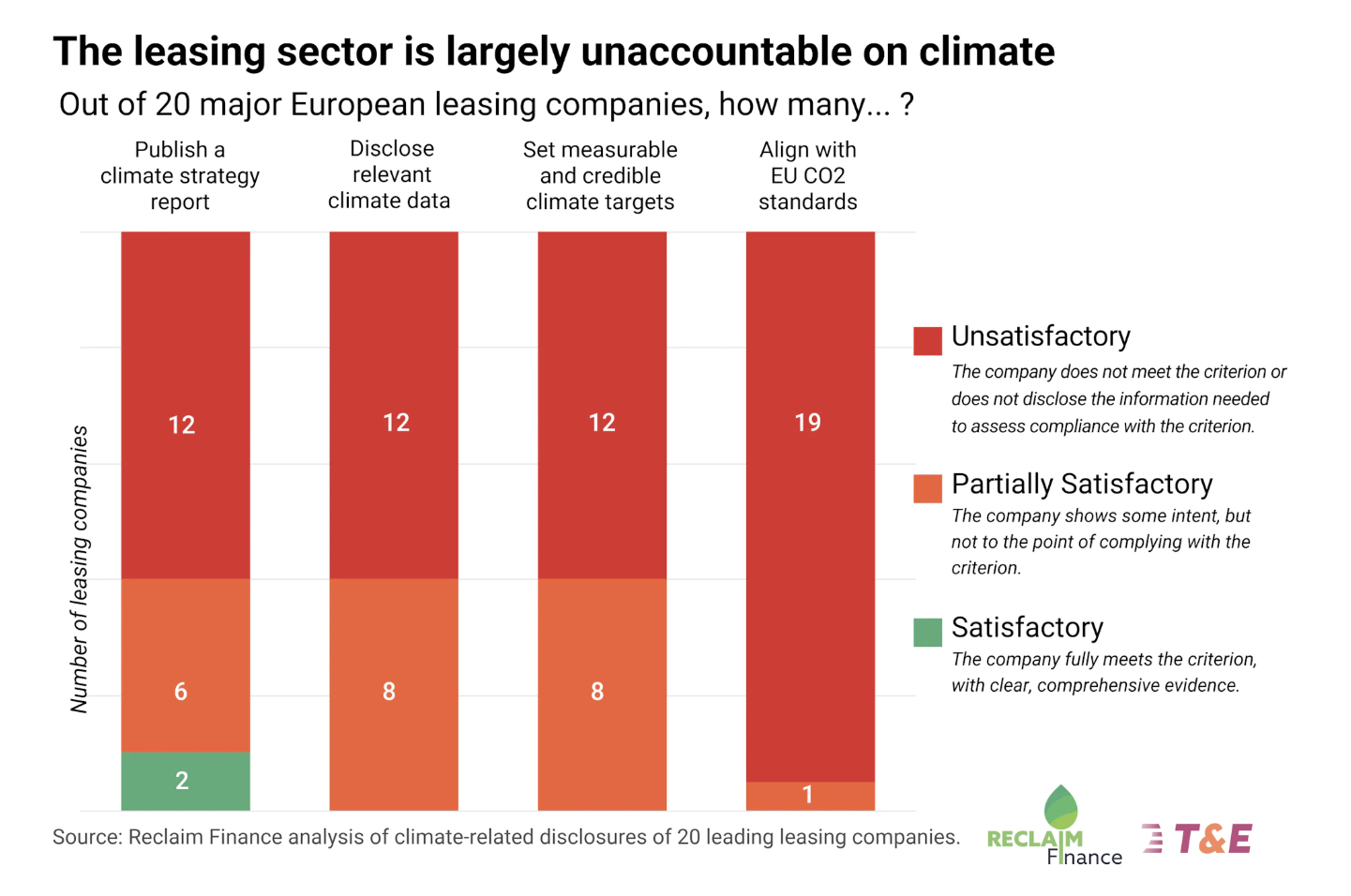

1. Reclaim Finance and T&E have analysed the local weather disclosures [1] of 20 main leasing corporations [2]. The findings are regarding:

12 out of 20 leasing corporations publish no public data particularly about their leasing actions. Amongst them are main gamers like Stellantis Monetary Companies, Mercedes-Benz Monetary Companies, and Toyota Monetary Companies.

2. Even within the case of the 8 corporations that disclose data, none present a clear detailed breakdown of their fleets by car kind, nation, or yr, making it unattainable to judge their decarbonisation progress.

3. Solely 9 corporations have local weather targets, however these are fragmented, short-term, poorly detailed. Some have not too long ago been weakened or suspended, as seen with Arval (BNP Paribas), Ayvens (Société Générale), and Mobilize (Renault).

4. No leasing firm has dedicated to cease financing new ICE autos in Europe, even after 2035, when the EU plans to ban their sale.

“In contrast to carmakers, leasing corporations are usually not topic to any particular local weather laws. There’s presently no requirement for emissions transparency, no binding targets, and no phase-out timeline for inside combustion engine (ICE) autos. It’s hardly stunning, then, that the warning lights are flashing pink on the subject of decarbonisation — and that no leasing firm has dedicated to shifting away from fossil fuels,” explains Lucie Pinson, Govt Director at Reclaim Finance.

Regulation is urgently wanted

The conclusion is evident: policymakers must introduce insurance policies to reverse this pattern and be certain that leasing corporations play their position and develop into actual inexperienced leaders.

Reclaim Finance and T&E name on the European Fee, Members of the European Parliament and Member States to incorporate binding measures within the upcoming EU Fleets regulation, anticipated by the top of 2025:

1. Mandate transparency on leasing fleet information: car varieties, emissions, and fleet composition — damaged down by nation and yr;

2. Set regulatory targets for the electrification of leasing fleets, together with a phase-out of latest ICE car financing, by 2030 on the newest.

“This report is a wake-up name for policymakers. With out regulation, leasing corporations will proceed to dodge their obligations within the local weather transition—though they maintain most of the levers,” concludes Stef Cornelis, Fleets and Freight Director at T&E.

Obtain/learn the report.

Notes to Editors

[1] Given the restricted variety of complete local weather experiences printed by leasing corporations, all public communications associated to local weather have been reviewed, together with sustainability experiences, web sites, press releases, and many others.

[2] The 20 corporations analysed are: Alphabet (BMW), BMW Monetary Companies, Arval (BNP Paribas), Cofica Bail (BNP Paribas), Crédit Agricole Private Finance and Mobility (Crédit Agricole), Crédit Agricole Leasing and Factoring (Crédit Agricole), Leasys (Crédit Agricole, Stellatis), Crédit Mutuel Leasing (Crédit Mutuel), FCE Financial institution (Ford), BPCE Lease (Groupe BPCE), Hyundai Capital, Athlon (Mercedes-Benz), Mercedes-Benz Monetary Companies (Mercedes-Benz), Mobilize Monetary Companies (Renault), Ayvens (Société Générale), CGI Finance (Société Générale), Stellantis Monetary Companies (Stellantis), KINTO (Toyota), Toyota Monetary Companies (Toyota), Volkswagen Monetary Companies (Volkswagen).

Obtain/learn the report.

Information launch from T&E.

Join CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and excessive degree summaries, join our day by day publication, and comply with us on Google Information!

Whether or not you could have solar energy or not, please full our newest solar energy survey.

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Join our day by day publication for 15 new cleantech tales a day. Or join our weekly one on high tales of the week if day by day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage